1. Event Introduction

On July 7, 2025, Dow announced that it would close its Barry, UK, base siloxane plant in mid-2026. The plant is part of the High Performance Materials and Coatings Division. The closure is part of Dow's European asset optimization plan, involving three upstream assets, aimed at reducing high-cost, high-energy consumption production capacity and focusing on high-value-added derivatives. Dow stated that this move will optimize the European production capacity layout, reduce business risks and increase overall profits.

2. The ups and downs of the Barry plant

The predecessor of the Barry Base Siloxane Plant in the UK was the silicone plant of the British ICI Company, which was later acquired by Dow Corning and gradually expanded.

Dow Corning Period: Became an industry benchmark with its world-leading technology and global layout 1990-1994: Dow Corning expanded the production capacity of the Bari plant from 32,000 tons/year to 55,000 tons/year, making it an important silicone production base in Europe. 1999: Dow Corning invested $240 million to start a large-scale expansion, achieving a siloxane production capacity of 200,000 tons/year by 2005, becoming the largest silicone plant in Europe.

Dow period: Faced with rising manufacturing costs in Europe and global overcapacity, Dow ultimately chose strategic contraction. In 2016, Dow completed the full acquisition of Dow Corning and integrated it into the "Dow Siloxanes" business, and the Barry plant was incorporated into the Dow system. In 2020, Dow shut down an old production line at its Barry Base Siloxanes plant in the UK, and the plant's production capacity was reduced to 145,000 tons/year. In July 2025, Dow announced that its board of directors had approved the closure of Dow's Barry Base Siloxanes plant in the UK.

3. Dilemma of European chemical industry

The closure of the Bari plant is not an isolated case. Recently, giants including Huntsman, Celanese, INEOS, Covestro, Arkema, Chemours, Akzo Nobel, Shell, Total Energy, etc. have successively reduced or optimized their European businesses (European chemical industry, the future is worrying!).

Behind these adjustments is the systemic dilemma faced by the European chemical industry: high energy costs (relevant data show that European natural gas prices in the first quarter of 2025 are 3.3 times that of the United States), carbon taxes and environmental regulations that push up operating costs, and the superposition of global overcapacity and weak demand.

In this predicament, Dow Chemical is facing particularly significant operating pressure. The first quarter financial report of 2025 shows that the company's net sales fell 3% year-on-year to US$10.4 billion, and net profit turned from profit to loss to US$290 million, a year-on-year plunge of 65.9%, and operating cash flow dropped sharply from US$458 million to US$104 million. By reducing the upstream production capacity of silicone in Europe, Dow will be able to shift production resources to bases in the United States and China, which will not only improve the capacity utilization rate in these regions, but also is expected to improve the medium- and long-term cash flow situation through structural adjustments. Although the closure of the Bari plant can be called "cutting off an arm to survive", it may be the only way for companies to maintain their vitality in the industry's cold winter.

4 Impact on the silicone industry chain

In 2024, Europe's total siloxane production capacity will be 475,000 tons/year, most of which will be used to meet domestic consumption. The closure of Dow's Barry, UK, base siloxane plant indicates that there will be a reduction in European production capacity of 145,000 tons/year, and supply will be reduced by nearly one-third. This is not only the largest withdrawal of upstream silicone production capacity in the world's history, but will also trigger a chain reaction in the industry chain:

The first thing to be affected is that the price of silicone base materials will be pushed up, which may alleviate the downward price pressure caused by global overcapacity to a certain extent.

For the remaining capacity, Elkem's French plant and Wacker's German plant are expected to take over part of the transfer demand, but under the dilemma of high overall chemical costs in Europe, whether these companies can solve the problem for a long time remains uncertain.

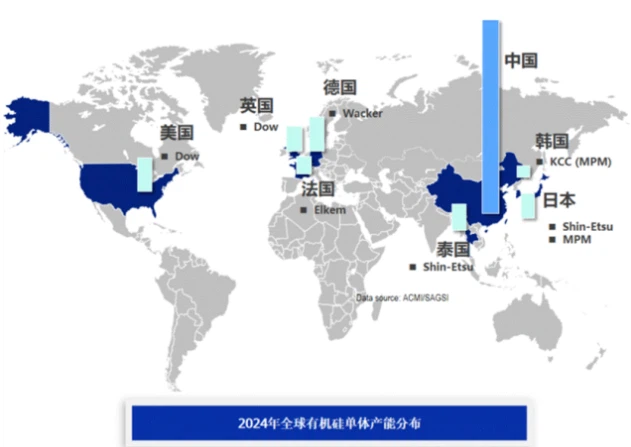

China's upstream silicone market will usher in structural opportunities. As the largest production and sales center with 75% of the global polysiloxane production capacity, the export volume of 80,000 tons to Europe in 2024 has laid the foundation. With the closure of the Bari plant, there is significant room for growth in the scale of China's silicone basic raw materials and products exports. However, we need to be vigilant about the balance between capacity expansion and technology upgrading to avoid falling into the trap of low-end competition.

In addition, local silicon metal suppliers will directly lose about 80,000 tons of market size. It is worth noting that Dow released the shutdown signal one year in advance and started the aftermath, showing strategic rationality and a positive attitude of responsibility to customers and the market, which should be recognized. The impact of the entire incident on the market will be released slowly, and the actual impact on the market in the short term will be limited.

Conclusion

The closing of the Bari plant, which was built in the Dow Corning era, proves that the wave of "deindustrialization" in the European chemical industry is difficult to reverse. When energy transformation and geo-economic pressure are intertwined, Dow's self-destructive move is not only a microcosm of industrial transfer, but also brings dual enlightenment to Chinese companies - not only to seize the window period of capacity replacement, but also to break through technical barriers and climb to the high end of the value chain.